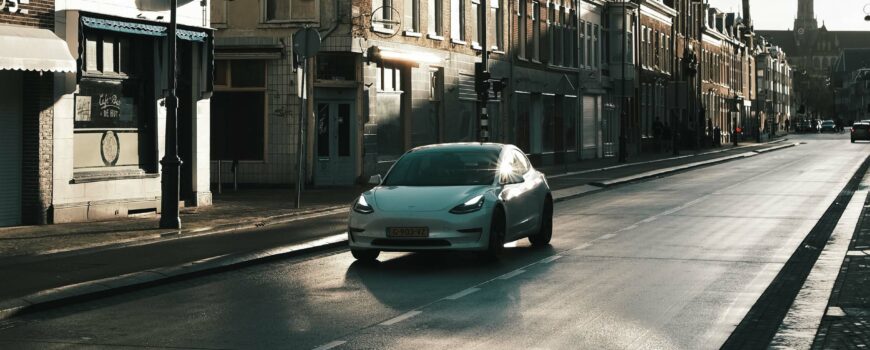

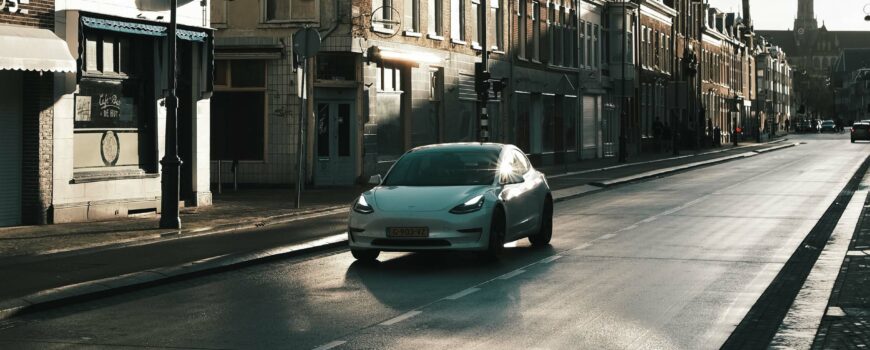

All full BEV’s (Battery Electric Vehicles) produce zero-emissions, and therefore qualify for the zero-rated standard tax incentive.

The good news is that in order to encourage a switch to zero-emission vehicles, the UK government has introduced a new piece of legislation. This allows all drivers of electric cars in the UK with zero-emissions, to be exempt from paying any road tax for the first year, and all successive years thereafter.

This means that if you own a zero-emissions vehicle, you will pay zero road tax!You can find out more about this incentive here.